State Farm 'Refines' Markets, Alters PCPs for Some Shops

Christy Hayes thought it was a mistake. She received the email, read through it, and instantly reached for the phone.

This was Nov. 5, the day she was informed that her and her husband’s shop—located in rural Sycamore, Ill., a town of just 17,500—had been placed in a new “government defined market” by State Farm.

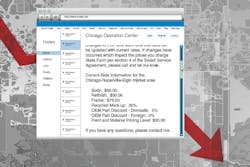

Hayes’ Body Shop Inc. is a Select Service shop, and as of receiving that email, the business was now considered to be part of the Chicago market (the shop is roughly 70 miles west of the city), a change brought on by the insurance giant’s effort in “refining certain market boundaries utilized to determine prevailing competitive prices (PCPs),” according to a copy of the email notification FenderBender obtained through a shop source.

And that PCP? For body work, it was now $50; same for refinishing. Paint and material pricing was now $30. Each of those new rates marked decreases of more than 10 percent for Hayes’ shop, which generates roughly 30–35 percent of its $2 million in overall sales through the Select Service program.

That’s when the phone call was made.

“I honestly called expecting them to say they sent me the wrong email, and that they’d forward the correct one,” Hayes says. “I was just—I was completely in shock.”

The change was effective as of Nov. 4, the day prior to the email notification. The new rates would be enforced immediately.

Widespread Move

According to a number of shops and industry consultants with close knowledge of the situation, Hayes’ story is similar to those heard throughout the U.S. last fall. State Farm announced in July that there would be changes made to designated markets in its 2015 Auto Repair Facility Survey, which it uses to determine PCPs and paint and material price levels for each area. Shifting the boundaries in some areas could result in PCP changes, the insurer warned at the time.

For many shops like Hayes’, that turned out to be the case. She was told the rates—and new market definition—were non-negotiable if she wanted to stay in the Select Service program.

When contacted by FenderBender, a State Farm representative said the company would not comment beyond its original July notification.

“We’ve been in business 30 years, and we’ve worked with State Farm for a long time over those years, and they’re a very good company to work with,” Hayes says. “We value that relationship a great deal. I’m just—it’s hard to understand a decision like this. I don’t get it.”

Neither did Jen Fisher, manager of her family’s Kenosha, Wis., shop, Jay-Bee Collision. Fisher was also informed of the market shift via email, and her shop—located in rural, southeastern Wisconsin—was also grouped in the Chicago metro. She also saw double-digit decreases in rates across the board.

“Our paint and materials levels are now back to what they were in 2008,” she says. “We checked back with our vendors, and since 2008, our paint and materials costs have increased 42 percent. It makes no sense.”

One shop owner in Kentucky told FenderBender that his market didn’t see a PCP reduction, but also hasn’t seen an increase from State Farm in six years. When his facility tried to charge $2 above the $40 PCP State Farm had set for the area, he says the insurer “refused” to pay it.

His facility is not part of the Select Service program.

Other shops in Louisiana have experienced similar issues, according to an email sent by Alysia Hanks, executive director of the Louisiana Collision Industry Association.

Ramifications and Reactions

Jay-Bee Collision is on the border of Kenosha County. Five miles up the road, Fisher says, is another shop in the State Farm program—one not in Kenosha County. That shop was not regrouped. Its $56-per-hour labor rate has remained.

“Throw out the difficulty this puts on our bottom line, and one of the big issues for us now,” Fisher says, “ is how this impacts recruiting technicians.

“We give our team raises based on the success of the business, and what we [receive as payment]. We’re not sure how this will affect all of that going forward.”

The other concern, according to multiple shop owners, is the fear that other insurers might look to do the same. Both Fisher and Hayes say they have never seen rates go backward in all their years working with multiple insurers. The fear of a new precedent is very real, they say.

Hayes’ shop is growing. The day Hayes received that email from State Farm, she had just hired two additional technicians, bringing her team to 11 total. She said her team will “buckle down” and try to run more work through the shop to make up for the slimmer margin on State Farm work.

But, as the emotion breaks through in her voice, she says that it’s a “Band-Aid fix” at best. They’re still looking for a long-term solution.

“I just keep hoping that this is a mistake. I mean, what are we supposed to do? What are we going to do? ” says Hayes before pausing; then she adds, reassuringly: “We’ ll get through this. We have to. We’ ll find a way.”

About the Author

Bryce Evans

Bryce Evans is the former vice president of content at 10 Missions Media, overseeing an award-winning team that produces FenderBender, Ratchet+Wrench and NOLN.