Collision industry consultant and former chairman of the Collision Industry Conference (CIC) Dale Delmege offers insight on the development of standards in the U.S. collision repair industry, including the direction it could head and the significant impact it could ultimately have on repairers.

Why are standards necessary for the collision repair industry?

There are about 6,000 quality shops that make continuous investments to acquire the resources required to make proper repairs. Then there are many others that haven’t remained current with best practices for excellence or safety.

Nobody knows the answer as to how many collision repair locations have the proper equipment and training, but nobody’s guess goes [above] 10 percent. That’s the result of almost a complete lack of standards. Anybody can fix cars with no credentials. Nobody verifies that you’re equipped and capable of repairing cars correctly.

What types of standards are needed for the collision industry?

There are two categories of standards needed for the collision industry to ensure accurate repairs. The first category is business resources, which consists of four concepts: equipment, materials, information and training. Shops need several things to properly work in the industry due to development of advanced vehicle designs and materials. Shops also need continuous access to new repair information and training to constantly learn new skills.

The second category of standards is methods for completing repairs. There are hundreds of methods published by the OEMs, but many holes still exist in the information. Nobody wants to abandon OEM methods, but somebody needs to fill in the blanks.

What direction do you see standards heading in the U.S.?

I-CAR is one option that has been considered to spearhead the effort, but that’s doubtful of taking hold. Standard development also won’t solely come from OEM, repair, or insurance organizations. Each of those three segments has natural vested self-interests in certain standards. Insurers cannot avoid the fact that they need to control costs and incentivize to reduce costs. Shops can’t avoid the natural inclination to maximize profitability of repairs. OEMs like to sell more parts and have interest in totals to sell more cars.

Standards shouldn’t come out of government, either. Elected officials would impose legislation on issues they don’t understand, which could lead to bad laws and regulations.

78 percent would trust a collaboration of industry associations to manage the effort, and 98 percent would trust I-CAR.

Standards will likely come from development of a third-party entity, an organization designed to gather all the information and set it up. There needs to be a credible, nonthreatening entity that is politically astute to make it happen. It will be something similar to the PAS 125 standard implemented in the U.K. under the British Standards Institute.

What would be the impact of standard development?

Standards would be good for quality repairers who are able to uphold them. It will never be something that’s mandated or enforced, but rather an advisory standard that’s recommended and voluntary. Participating repairers will get more cars because insurers will have no choice but to send customers to certified facilities.

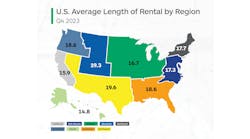

Right now, the industry is trying to spread 13 million claims across a huge overcapacity of shops. There are roughly 36,000 repair shops in the country, and only enough work for about 6,000. According to natural economics, there is huge downward pressure on prices when that amount of overcapacity exists. Downward pressure on price will remain constant as long as claims are spread so thinly across many locations.

Would standards lead to more rapid shrinking of the industry?

The hard fact is that a whole bunch of shops are going to close anyway with or without standards. About 3 million claims in the industry today—25 percent overall—are repaired by roughly 2,500 shops. Standards aside, there are 25,000 too many shops in the country.

State Farm Insurance had more than 19,000 direct repair shops 10 years ago. Now the company only has 10,000, and it wants to cut that number much further. If a company like State Farm can fix all vehicles with a network of 6,000 repairers, there is going to be a massive shakeout of shops.

There will be a handful of totally dominant insurers, and a handful of totally dominant repair groups. It’s economically inevitable. Repairers have to decide whether they’re willing to make necessary investments to prosper, survive and make their business more valuable to compete.