CCC Crash Course Q4 2025: Calibrations, Supply Chains, and Cost Dynamics

CCC Intelligent Solutions Inc. recently put out its Crash Course Q4 2025 Report, according to a recent press release. The final edition looks at the biggest themes from the year – from calibration and car parc shifts to supply chain pressures and casualty negotiation trends – to see how they collectively affect the collision repair and claims ecosystem.

The rise in calibration demands hit all shops. It wasn’t just the volume, but the variability of each vehicle. The differences in make, model, trim, sensor placement, and damage type widen the range of requirements and require more documentation, sequencing, and added repair steps. All of it together affects repair quality and cycle time.

Tariffs on imported auto parts stressed parts pricing and supply chains throughout the year. Even when claim frequency remained steady, the cost of fulfilling the average claim continued to rise. Repairers had to explain to customers why a simple bumper repair was waiting on a back-ordered sensor, absorb operational delays, and manage increasingly complex repair planning driven by calibration needs.

This year, casualty claims teams began to evolve their negotiation strategies, implementing a structured, evidence-based approach emphasizing injury, functional impact, causation, and clarity around treatment rationale. In doing so, they were able to move negotiation from a late-stage settlement activity to a more strategic, disciplined component of liability management.

The average vehicle age continued to rise as affordability challenges ranging from higher new vehicle prices to elevated interest rates pushed consumers to hold onto cars longer. The car parc composition was dominated by SUVs and crossovers, while the presence of hybrids and EVs grew, introducing new repairs, parts, and underwriting considerations. New vehicles also added increasing repair complexities as shops needed to tackle embedded electronics, a broader presence of ADAS, and increasingly integrated components. The result was more diagnostics, more calibrations, and costlier repair procedures.

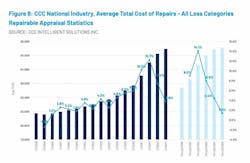

Though likely to develop higher, the year-to-date average total cost of repair (TCOR) is +1.4% year-over year, at $4,768. The average TCOR finished 2024 at over $4,730, or +3.8% year-over-year. This was the lowest increase since 2017, and CCC said it is likely to see a sub-2% increase in 2025. Increases in repair costs have been mitigated by the increase in total losses and age mix; almost 46% of repairable vehicles are seven years or older, generally requiring less parts and labor hours.

CCC concludes that if this year revealed the pressure points, 2026 offers the opportunity to strengthen them. Success will come to the organizations that treat these insights to shape a path forward – one that supports a more resilient claims and repair ecosystem in the year ahead.

The full report is available here.