The growing complexity of new vehicles, most of which are now sold with advanced driver assistance systems (ADAS,) is a major factor in steep repair costs, according to SambaSafety. In its 2025 Driver Risk Report, it notes that premium increases have improved the outlook for profitability in property and casualty underwriting, but "commercial auto continues to lag," suggesting premiums could see additional increases.

All figures are sourced from the SambaSafety report released May 15.

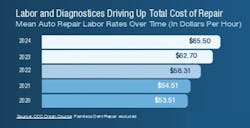

Labor and Diagnostics Driving Up Total Cost of Repair

Vehicle complexity, including the growing average number of replacement parts up by 15% and lightweight parts that more often need to be replaced instead of repaired, means repair times are longer and the labor required for this is more specialized. Labor and miscellaneous costs, which include diagnostics, are the greatest contributor, the report cites using CCC Crash Course statistics. "Even minor collisions necessitate the recalibration of sensors and camera systems," the SambaSafety report notes.

How Tariffs Are Expected to Impact Costs

Imported Auto Parts into the U.S. by Country in 2023

Editor's note: As the White House continually shifts its policies on tariffs, this information is believed to be accurate as of press time but is subject to change.

The report notes that imported auto parts made up $84 billion in 2023, citing International Trade Centre statistics, and could further increase costs. In 2024, 82% of car windows came from Mexico, Canada and China, the report cites from S&P Global Mobility statistics. About 10% of imported auto parts originate from South Korea and Taiwan, of which the current imposed tariffs for auto and steel are 25%. "As costs for auto glass, bumpers and other components rise, the effect on auto physical damage coverage will be felt sharply by insurers and their policyholders," the report notes.

About the Author

Jay Sicht

Editor-in-Chief, FenderBender and ABRN

Jay Sicht is editor-in-chief of FenderBender and ABRN. He has worked in the automotive aftermarket for more than 29 years, including in a number of sales and technical support roles in paint/parts distribution and service/repair. He has a bachelor's degree in journalism from the University of Central Missouri with a minor in aviation, and as a writer and editor, he has covered all segments of the automotive aftermarket for more than 20 of those years, including formerly serving as editor-in-chief of Motor Age and Aftermarket Business World. Connect with him on LinkedIn.

Don't miss Jay's next article or podcast. Sign up for FenderBender Today's Collision Repair News and ABRN eNews here.