Storms Spur Insurers to Grow Repair Networks

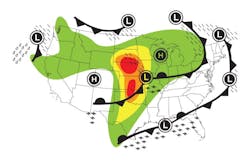

Unusually frequent and severe storms hit the U.S. hard in 2011. The country experienced 171 catastrophic events, the fifth highest number on record, and tallied 99 Federal Disaster Declarations, the most since 1953.

Abnormal weather patterns have continued in 2012. Seventy tornadoes were recorded in January—the third highest in that month since 1950. The storm season is expected to run about 30 percent higher compared with recent years, and experts predict the U.S. will continue to see more severe types of weather moving forward, says Susanna Gotsch, industry analyst for CCC Information Services Inc.

As a result, Gotsch says some auto insurers are putting precautionary measures in place to ensure they’re able to efficiently handle claims post-catastrophe. Weather-related disasters raise the volume of claims on short notice, and insurance carriers are looking for alternative ways to ramp-up their processes when they experience an unexpected spike in work. In fact, insurance commissioners in Washington, California and New York are now requiring insurance companies to disclose how they plan to respond to claims during such scenarios.

The problem, however, is that auto claims frequency has been declining year-over-year, Gotsch says. That has caused several insurance companies to reduce their staff sizes in order to reduce company expenses. Adjusters have been the segment of employees most affected by layoffs, which has left some insurers short-handed to effectively handle claims processes when a sudden increase in repair volume occurs.

Now, many U.S. insurers are expanding their repair networks to include a broader range of shops that aren’t included in the companies’ normal direct repair programs (DRP). The purpose is to have additional shops in place, which offer the same value and capabilities as their DRP partners, to help manage an increase in repair volume when storms hit.

Steve Bruce, president of Quality Claims Solutions, says this is true for insurance companies across the country. But the trend is especially prominent among many smaller insurance carriers. He says many small-sized insurers might have DRP networks in a handful of states, but about 20–25 percent of their clients typically reside in territories where company DRPs do not exist.

Those insurers need to address how to best serve those clients after catastrophic situations, Bruce says. Historically, insurers work with independent appraisers to serve those clients, but that might not be an option when storms strike. Consequently, they need additional coverage to handle those territories from a repair perspective so they don’t fall by the wayside.

He says the number of shops that insurers want to add to their network varies between companies. The percentage of claims increase will be directly proportional to the necessary increase in their repair coverage.

“There are several insurance companies that are expanding their repair networks like this,” Bruce says. “This is a trend that will continue.”

Bruce says this presents an opportunity for shops that haven’t been able to get on an insurer’s DRP network due to overcapacity. It’s a chance to develop short-term, temporary relationships with insurers to increase work volume and revenue for shops.

“Shops should get in touch with insurers to discuss this, and make it a talking point during future interactions,” Bruce says. “Shops should let them know they would like to be included in the company’s expanded networks in case they need the shop’s services in the event of a catastrophic situation.”

Bruce says good performance on behalf of shops during those temporary partnerships could also lead to more long-term relationships with insurance carriers.